The IMO 2020 rule a year and a couple of months away, scrubber systems are beginning to make waves among shipowners, with reports from DNV GL that over the past six months, more than 1,000 of them have been sold.

In its latest weekly report, shipbroker Gibson said that “not so long ago, a lot of tanker and dry cargo owners had been fiercely opposed to the installation of exhaust gas cleaning technology. However, the attitude is rapidly starting to change. Following a surprise announcement by Frontline and DHT a few months ago to install scrubbers on their fleets, we have seen a notable increase in other owners committing to the installation as well.

Last week DNV GL reported that over the past six months more than 1,000 scrubber systems (mainly retrofits) have been ordered across global merchant fleet, with the total number to date currently standing around 1,850 units for vessels fitted with scrubbers or have installations booked. The classification society also notes that hybrid systems are the most popular, due to possible restrictions over usage of open loop scrubbers”.

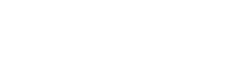

According to the shipbroker, “the fact that scrubbers are becoming more and more popular is not surprising. There is a strong financial argument in favour of installation, on the basis of a short repayment period of the costs involved and prospects for additional savings thereafter. Of course, scrubber economics largely depend on the $/tonne spread between HSFO and the compliant 0.5% bunker fuel.

There is an ongoing market debate at what level it will be in 2020, with the estimates ranging from $200/tonne to $450/tonne. If the forward prices are used as an indication of the future spread, the difference in swap contracts for high sulphur fuel oil vs 0.1% sulphur gasoil basis FOB ARA is currently trading just over $350/tonne for the 1st quarter 2020. However, over time the spread is expected to decline as refiners’ ability to produce compliant bunker fuels increases. As such, early adopters of the technology will benefit the most both in terms of the shortest scrubber repayment period and the maximum additional savings once the costs are repaid”.

Early adopters of scrubber technology will benefit the most both in terms of the shortest scrubber repayment period and the maximum additional savings once the costs are repaid.

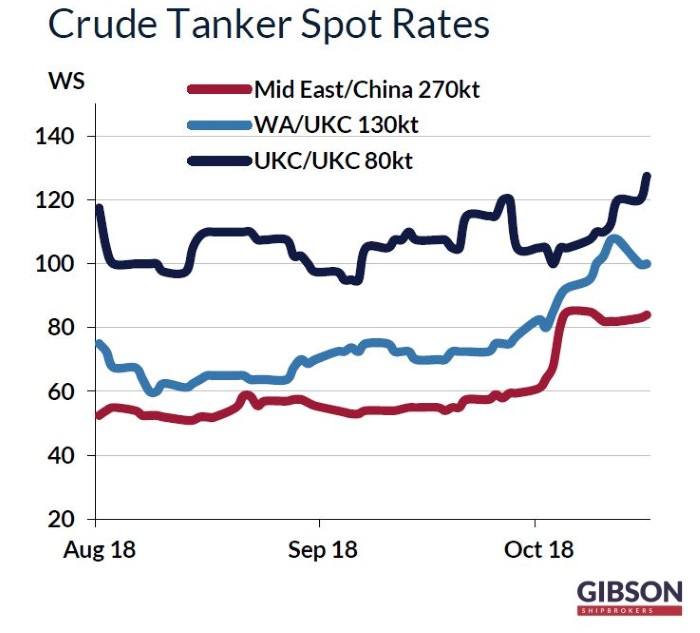

Gibson added that “in the tanker space, interest in scrubbers is most evident in the VLCC segment. Again, this is not surprising as VLCCs travel the longest distances and have the highest bunker consumption. As of now, nearly 20% of the existing VLCC fleet could be fitted with technology by 2020, if we are to count not only tankers where installation has been confirmed but also those where installation is planned and those which currently have “scrubber ready” status. There is also an element of the unknown. Although quite a few owners have confirmed installations on specific vessels; there are others which have only vaguely indicated that scrubbers will be installed on a number of vessels within their fleets.

In addition, some deals could also have been done privately. As we move closer to 2020, we expect the size of the scrubber fitted fleet to increase. Further details of specific installations are likely to emerge. Likewise, as more scrubbers are confirmed to be fitted, owners that remain sceptical of the technology could come under pressure to follow suit in order not to find themselves at severe disadvantage versus the scrubber-equipped competition. For now, however, the biggest limiting factor is the capacity constraints: it is unrealistic to equip the whole global tanker fleet with the technology by January 2020.

Yet, the situation could be very different in a few years after that. If the current trend continues, sooner or later the majority of the fleet could be scrubber fitted. At this point freight levels are likely be dictated by vessels operating with scrubbers on board, while the cost of installation will simply become just an extra expense, absorbed by the owner… Of course, for now this is just a hypothetical scenario.

There are still plenty of owners who are not convinced, with HSFO bunker availability, risk of price spreads narrowing over time, environmental and future regulatory changes being amongst the key concerns. For those owners, it is still very much a “wait and see” approach. Only time will tell whether they have waited too long or adopted a prudent forward strategy”, the shipbroker concluded.

Source : Hellenicshippingnews -Nikos Roussanoglou – October 22 2018